About the UWUA

Finances

The UWUA is by no means a charity. It is a big business, surviving on the dues, fees and fines of its hard-working members.

The UWUA is required each year to file a document called an “LM-2,” which reports the union’s most recent financial flow. It also provides information on how the union collects and spends its members’ dues and fees.

Workers pay for most of the union’s costs and overhead through their dues. These costs include lobbying, travel and the salaries and benefits for union officers and staff.

UWUA Spending

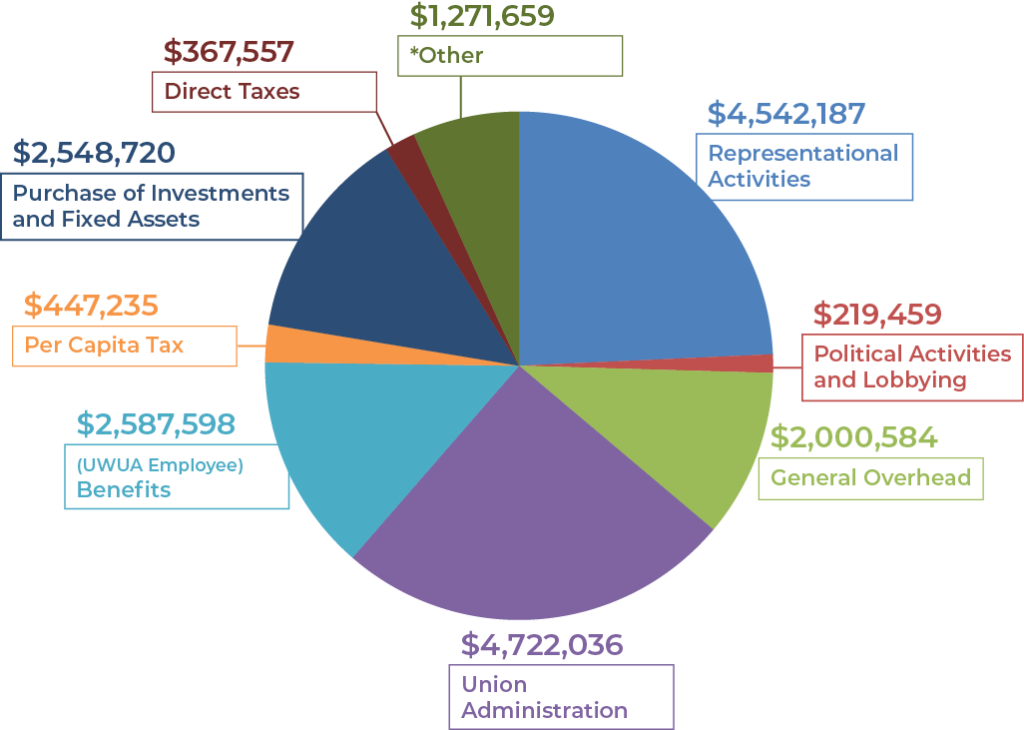

The chart below breaks down how the UWUA spent $18,707,035.

Source: 2024 UWUA LM-2 Report. *Other: Contributions, Gifts, and Grants; Supplies for Resale; Loans Made; To Affiliates of Funds Collected on Their Behalf; Less Total Disbursed.